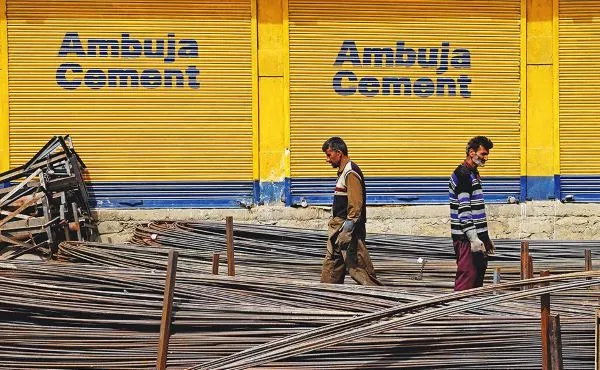

The Adani family, led by billionaire Gautam Adani, has bolstered its investment in Ambuja Cements by injecting an additional Rs 8,339 crore, raising its stake in the company to 70.3%. This move aims to support Ambuja Cement’s manufacturing capacity enhancement endeavors.

Previously, the Adani family had invested Rs 5,000 crore on October 18, 2022, and Rs 6,661 crore on March 28, 2024, in the company. With this latest infusion, they have completed a planned investment of Rs 20,000 crore in Ambuja Cements.

The company stated, “The promoters of the company – Adani family – has fully subscribed to the warrants program in the company by further infusing Rs 8,339 crore, thereby infusing a total amount of Rs 20,000 crore.”

This infusion has elevated the Adani family’s stake in Ambuja Cement by 3.6%, now reaching 70.3%. Overall, their holding in Ambuja Cement has risen from 63.2% to 70.3%.

The funding injection is expected to aid Ambuja Cement in accelerating its growth aspirations, aiming to nearly double its existing capacity to 140 million tonnes per annum by 2028 from 76.1 million tonnes as of December 31.

According to the statement, “With this, promoters have further strengthened Ambuja post-acquisition, giving Ambuja capital flexibility for accelerated growth, capital management initiatives and best-in-class balance sheet strength to accomplish its various strategic initiatives.”

In 2022, the Adani group made a significant move into the cement sector through a USD 10.5 billion deal to acquire Ambuja and ACC from Swiss giant Holcim.

Ajay Kapur, CEO of Ambuja Cements Ltd., expressed, “This infusion of funds provides Ambuja, capital flexibility for fast-tracked growth, capital management initiatives and best-in-class balance sheet strength. It is not only a testament to a steadfast belief in our vision and business model but also reinforces our commitment to delivering long-term sustainable value creation to our stakeholders.”