Colliers’ latest Global Insights & Outlook – Office Report reveals the significant divergence in office investment volumes, pricing, and appetite globally, caused by the varying return to office approaches post-COVID, underlying fundamentals of city functionality, approaches towards ESG-compliance differences and how markets have reacted to shifts in inflation and interest rates.

In India, the office sector continues to dominate institutional investment inflows garnering over 44% in total investments in last five years (2018-22). Despite economic uncertainties and global slowdown, investments in office sector remained unabated during Q1 2023 as well, at USD0.9bn, up 41% YoY. India remains a preferred market for global investors for office investments driven by growth opportunities in tier 1 & tier 2 cities, attractive & stable yields and strong demand in established markets. However, limited availability of quality office assets at attractive valuations has pushed investors towards creation of new platforms and joint ventures (JVs) with developers for development of new projects across larger markets. While there could be some slower fund deployment in short term amidst uncertain and cautious environment, India’s economic resiliency, supportive government policy and improving business environment will enable to maintain its position as an attractive market for global investors in the long term.

“Amidst global recalibrations of office space driven by cost control, hybrid work culture, and business slowdown, markets like India continue to benefit due to lower costs with quality of assets, talent pool availability, and increased institutionalized framework. Although global sentiments have reduced the Investor activity in India, institutional buyers remain bullish over the medium to long term as the underlying demand for Office space remains strong and markets like India benefit from the shift in office market dynamics.” says Piyush Gupta, Managing Director, Capital Markets & Investment Services.

Institutional inflows in office sector (USD bn) – India

| 2018 | 2019 | 2020 | 2021 | 2022 | Q1 2023 | |

| Investments in office sector (USD bn) | 3.2 | 2.8 | 2.2 | 1.3 | 2.0 | 0.9 |

| Share in total investments | 55% | 45% | 46% | 32% | 41% | 55% |

Source: Colliers

Asia Pacific Highlights

- Melbourne and Tokyo stand out on the path to value stability and recovery along with Copenhagen, Toronto and San Francisco at the global level.

- While core offices remain a top pick for investors in APAC and EMEA, substantiated by current office investment volumes, there is a very different narrative in North America.

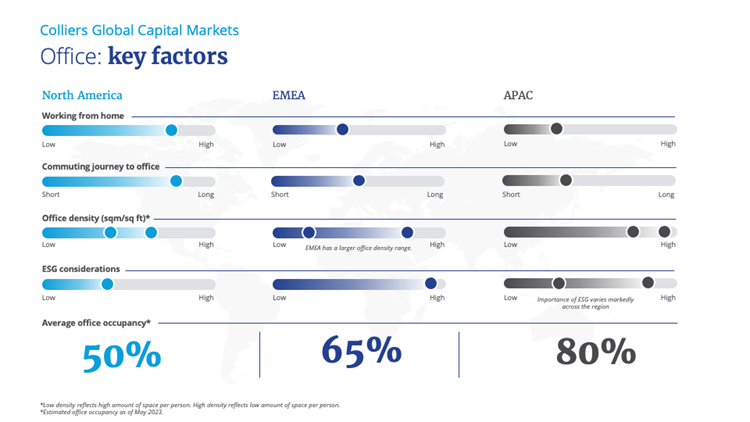

- Office occupancy levels in APAC are averaging 80%, and office density remains high. In Europe, occupancy is back to 65% and in North America, rates are at 50% with signs of improvements across key cities.

- Both Seoul and Singapore recorded net absorption 30% above historical averages with both markets recording falling vacancy rates over 2022, contrary to most major markets globally.

- Although limited sales transactions occurred over Q1 2023, we anticipate market sentiment will recover as an expected peak of the interest rate cycle comes to fruition over H2 2023 and equips investors and vendors with clarity and confidence regarding asset values and the cost of borrowing across the region.

In APAC and EMEA, vacancies sit at a steady 8-10% and office occupancy rates have largely returned to pre-pandemic levels. Office occupancy in APAC is averaging 80%, and office density remains high – a function of short commute times and ease of getting back into the office (Exhibit 1). Meanwhile, occupancy is back to 65% on average across Europe. In North America, rates are sticking at 50% but are showing some signs of early improvement, as longer travel times and more comfortable home working environments support this dynamic. Coupled with weak occupier demand, vacancy rates in North America have climbed to 16%+ on average, and landlord incentives to support rents continue to be stretched.

In India, office demand has recovered faster despite persistent global headwinds in the form of economic disruptions & geopolitical tensions. 2022 saw 50.3 mn sq ft of office leasing across top 6 cities, which was the highest in any year.. Q1 2023, however started on a cautious note with a total leasing of 10.1 mn sq ft across top 6 cities, 19% lesser than same period last year. Technology sector led leasing during Q1 2023 at 22% share, closely followed by Flex space at 20% share. Flex spaces have emerged as a compelling alternative to traditional office spaces for occupiers, due to their ability to support occupiers’ evolving hybrid strategies.

“On account of robust office space absorption seen during 2022, office occupancy levels across the top 6 cities saw strong recovery & currently stand at 84%, well ahead of 80% in APAC and 65% in Europe. High occupancy levels indicate healthy recovery and stability of the Indian office market, despite persistent global demand headwinds. Going ahead, demand for office spaces will continue to remain strong, as offices will continue to support occupiers’ changing workplace needs. As demand improves towards the latter part of the year, higher occupancy levels will likely push rentals northwards in 2024, which remained largely rangebound for the last 2-3 years,” says Vimal Nadar, Senior Director and Head of Research, Colliers India.

At the same time, prime rents across Europe are increasing as the demand for higher-quality space, particularly for assets that are ESG compliant, is significant. “We are seeing pressure to repurpose space that doesn’t meet contemporary demands as a growing proportion of buildings face obsolescence,” said Luke Dawson, Head of Global and EMEA Capital Markets at Colliers. “This is driving a shift in value-add plays across key markets, especially where high importance is placed on ESG, such as the UK and Australia.”

Capital values have been negatively impacted in the past 12 months, as interest rate hikes have forced yields/cap rates out. While most locations are nearing the end of the rate hike cycle, further price adjustments on the capital side are expected. The longer-term economic outlook for each city is generally very positive, but rates of growth vary markedly. Overall, this means some markets stand out as having a first mover advantage on the path to value stability and recovery.

As Hybrid working remains the mainstay for occupiers in India, relevance of physical office space remains intact. Occupiers are focusing on optimal locations, high-quality amenities, and well-designed fit-outs as they look to create an enriching experience for their employees. Focus on ESG complaint buildings also remains priority for occupiers as they look to achieve greater operational efficiency and reduce energy consumption in order to meet their net zero goals. Developers are increasingly taking cognizance of the evolving needs of occupiers and are integrating smart technology and sustainable infrastructure in their workspace offerings. Going forward, office space will continue to upgrade their workspaces through smart technologies such as the Internet of Things (IoT) and predictive analytics for cost optimization, carbon reduction and better space utilization. As ESG becomes vital to occupiers, green financing will become an integral part of investors’ strategy.

Exhibit 1

To find out more, read Colliers Global Insights & Outlook – Office Report here: Link to download

About Colliers

Colliers (NASDAQ, TSX: CIGI) is a leading diversified professional services and investment management company. With operations in 66 countries, our 18,000 enterprising professionals work collaboratively to provide expert real estate and investment advice to clients. For more than 28 years, our experienced leadership with significant inside ownership has delivered compound annual investment returns of approximately 20% for shareholders. With annual revenues of $4.5 billion and $98 billion of assets under management, Colliers maximizes the potential of property and real assets to accelerate the success of our clients, our investors and our people. Learn more at corporate.colliers.com, Twitter @Colliers or LinkedIn.