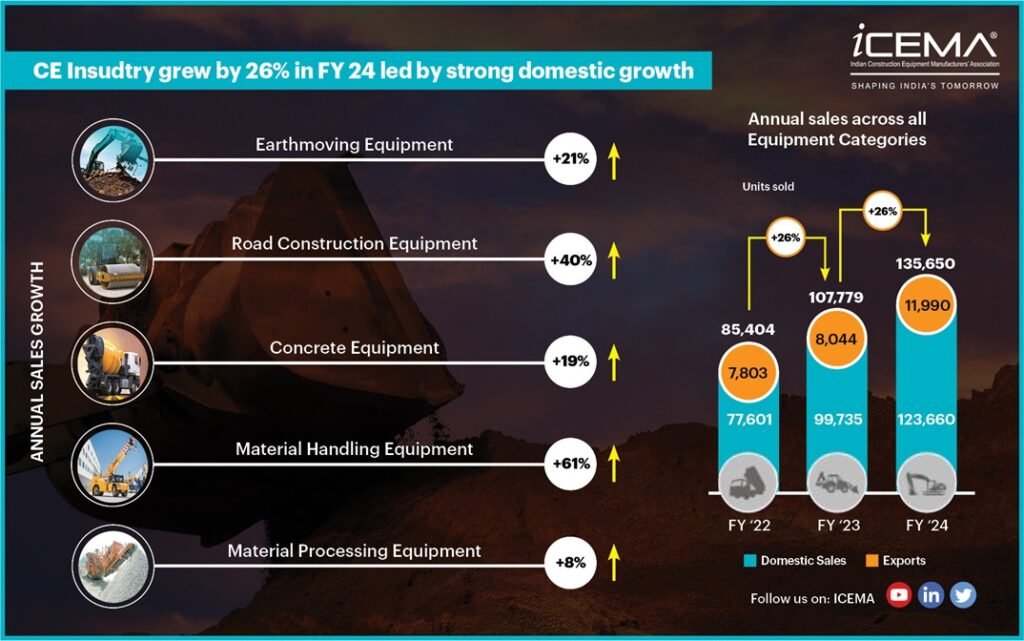

With total equipment sales crossing 1,35,650 units as against 1,07,779 lakh units in FY23, the Indian Construction Equipment industry has recorded 26% increase in overall sales volume for the financial year 2023-24, surpassing all projections. With these landmark figures, the CE industry has set yet another record, thereby sustaining the previous year’s growth momentum. The industry’s excellent annual performance has been a result of significant increase in demand for Construction Equipment observed in both domestic as well as exports markets, by 24% and 49% respectively.

“The Government’s renewed emphasis on the infrastructure sector through increased budgetary outlays as well as other incentives has been the primary force propelling the Construction Equipment industry on its current high-growth trajectory. Besides the increasing demand generated by the projects in the National Infrastructure Pipeline, the endeavours undertaken by the industry as well as policymakers to build capacity and competitiveness of domestic manufacturers and become a global hub for CE is showing results, with exports witnessing a strong growth”, said Mr. V. Vivekanand, President, ICEMA and Managing Director, Caterpillar India Pvt. Ltd.

Mr. Deepak Shetty, President Designate, ICEMA and CEO & MD, JCB India said, “As a result of rising budgetary allocations there is increasing demand for infrastructure development, urbanisation and industrialisation, but at the same time, it is also very heartening to see the rural economy emerge as a strong growth driver for the CE industry, which together, helped the industry to record significant growth during FY24”.

“The pre-election push, in the form of the enhanced pace of implementation of infrastructure projects in the pipeline, along with awarding of a record number of new projects resulted in a significant increase in demand for construction equipment, and was the primary factor behind the growth”, said Mr. Jaideep Shekhar, Convener, ICEMA Industry Analysis & Insights Panel and VP & Managing Director – APAC & EMEAR, Terex India Pvt. Ltd. “Other factors that contributed to the stellar performance of the CE industry in FY24 included an increase in construction activity in other sectors including urban infrastructure, rural, waterworks, airports and ports, and an upswing in mining activity which created an increased demand for material processing equipment”, he added.

“In view of the targets of Viksit Bharat 2047, infrastructure development would continue to be a focus area, to build India into a developed nation. ICEMA takes pride in partnering in the endeavors for Shaping India’s Tomorrow. Concomitantly, ICEMA is also working towards enabling transformation of the Indian CE industry for enhanced Safety of the jobsite, Sustainability of the products to attain net zero emissions, and Solutions that can build world class infrastructure which would stand the test of time” said Mr Vivekanand.

Mr. Shetty further added, “The industry has significant potential to contribute to the country’s economic growth and social development, and to also emerge as a global leader in the sector, in the coming future”.

KEY HIGHLIGHTS:

- Total sales of Earthmoving Equipment – the largest equipment segment of the CE industry – increased to 93,531 units in FY24, which is 21% higher than 77,164 units sold in FY23, accounting for approximately 70% of the total construction equipment sales in FY24. Of this segment, the lion’s share was accounted for by 55% and 35% respective growth in sales of Backhoe Loaders and Crawler Excavators, which together make up 90% of total Earthmoving Equipment sales.

- Material Handling Equipment including Pick & Carry Cranes and Telehandlers, recorded an impressive 61% growth in sales volume in FY24, and accounted for 14% of total CE sales, as compared to 9% in FY23.

- Concrete Equipment such as Concrete Mixers, Batching Plants, Concrete Pumps and Boom Pumps together recorded a 19% YoY increase in FY24.

- Road Construction Equipment, which was the only segment with negative growth in FY23, made a spectacular recovery in FY 24 by selling 6,571 equipment units – a 40% increase from 4,828 units sold in FY23. This turnaround has been powered by the increase in the pace and consistency of road and highway construction, in the run-up to the General Elections. While highway construction rate during the year touched 34 km/day, railway line laying rate averaged to 14 km/day, which supported the overall growth of the CE industry significantly.

- Material Processing Equipment sales increased to 2,625 units in FY24 – an 8% growth over 2,429 units sold in FY23.

While the CE industry expects a slight slowdown in the growth momentum in FY25 owing to General Elections, the overall prospects of the industry is expected to remain positive in the long term, due to the Government’s continued focus on infrastructure and increased mining activities to reduce import dependency of the country.

The ICEMA Panel on Industry Analysis and Insights provides robust and credible market intelligence by collating, generating, and analysing industry data. The value-added quarterly CE Industry Report is among the several industry reports collated based on data shared by its member companies which represent about 95% of the OEMs operating in the Indian Construction Equipment industry.

ICEMA (Indian Construction Equipment Manufacturers Association) is the nodal body representing the Construction Equipment industry (OEMs, suppliers and FIs) in the country and is affiliated to Confederation of Indian Industry (CII).